By Matt Bowen

•

September 15, 2025

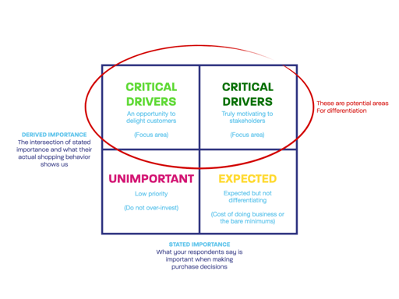

Your brand might not be as clear to your customers as you think. While internal teams focus on strategy and execution, customers only see the end result. This disconnect can lead to blind spots, inconsistent messaging, and missed opportunities. What’s the solution? An objective brand assessment. By bringing in an external perspective, you can identify gaps in how your brand is perceived, align your messaging with customer needs, and uncover areas for improvement. Here’s why it matters: Internal biases often mask issues like tone drift, outdated visuals, or unclear messaging. Competitor analysis reveals overused industry clichés and helps you stand out. Data-driven tools like customer surveys and message testing provide actionable insights. Consistent messaging across all platforms can boost revenue by up to 23%. An objective review doesn’t just clarify your brand’s position - it leads to measurable growth, better alignment within your team, and stronger customer connections. If your sales are slipping, your messaging feels outdated, or your brand is blending into the crowd, it’s time to reassess. Outside Perspective and Blind Spots When you're deeply involved in your brand's daily operations, it's easy to lose sight of how others perceive it. This "tunnel vision" can lead to blind spots where internal clarity doesn't match external impressions, potentially weakening your brand's impact. Finding Blind Spots with Fresh Eyes Blind spots often go unnoticed by internal teams but are glaringly obvious to your audience. This disconnect can damage credibility and reduce your brand's effectiveness [ 1 ]. Take "tone drift" or "visual drift", for example. Over time, subtle changes in messaging or design can creep in without anyone on the inside noticing. Yet, customers quickly pick up on these inconsistencies. Maybe your brand voice shifts slightly with each new campaign or hire, causing it to stray from its original identity and leaving customers confused. External reviewers frequently identify issues like inconsistent social media tones, a mismatch between brand values and customer support actions, or outdated visuals and messaging [ 1 ]. Even before customers directly interact with your brand, their perception starts forming based on factors like your website layout, bio text, pinned posts, or response times [ 1 ]. Another challenge is the "internal silence" that can form within teams. When dissenting opinions aren't encouraged, it's harder to question assumptions or spot new opportunities [ 3 ]. This is where outside reviewers or external experts can make a big difference. They bring an unbiased perspective, unclouded by daily involvement, to challenge assumptions and identify blind spots [ 1 ][ 3 ]. A simple yet powerful tool to test your brand's clarity is the "Stranger Test." Show your website or social media to someone unfamiliar with your brand for just a few seconds, then ask them what they think you do. If their answer misses the mark, it could signal that your messaging isn't clear [ 2 ]. But blind spots aren't just about processes. Leadership bias can also distort how a brand evolves, making it crucial to balance strategic vision with customer data. Balancing Leadership Opinions with Customer Data Leadership often comes with strong emotional ties to certain messages, visuals, or strategies. While this passion can spark creativity, it can also make it harder to adapt to what customers truly need. Just as fresh eyes can uncover misalignments in branding, they can also help recalibrate leadership's deeply held beliefs. External feedback provides the distance needed to spot these hidden biases and align strategies with customer expectations [ 1 ]. The key is finding a balance between leadership's insights and customer data. Leadership offers valuable context and strategic vision, but pairing these with external feedback creates a more grounded approach. External agencies, for instance, can provide tools like sentiment analysis, social listening, and competitor tracking - areas that internal teams might overlook [ 1 ]. These insights reveal what resonates with your audience, what doesn't, and where untapped opportunities might lie. The most effective brand evaluations blend leadership's vision with customer realities. Being too close to your brand can make it hard to see missteps or confusion, which is why an outside perspective is essential for gaining clarity and improving alignment [ 2 ]. Competitor Analysis and Differentiation Understanding your competitive landscape isn't just about knowing who your competitors are. It's about recognizing where predictable, overused messaging dominates and carving out a distinct voice for your brand. Without differentiation, brands risk blending into the noise, becoming just another face in the crowd. Spotting Industry Clichés and Generic Messaging Every industry has its share of buzzwords that get thrown around so often they lose their impact. Phrases like "best in class," "world-class," "AI-powered," or "industry-leading" are prime examples. These terms have been used so frequently that they no longer set brands apart, making it easy for competitors to overshadow them [ 5 ]. When messaging relies on these overplayed terms, it becomes generic and uninspiring. This can alienate customers, weaken trust, and hurt your brand's credibility, ultimately impacting conversion rates [ 4 ]. Conducting a thorough competitor analysis helps identify these overused phrases and patterns. Once you see what’s being repeated across the industry, you can focus on refreshing your messaging. By stepping away from clichés, you open the door to uncovering overlooked opportunities that can set your brand apart. Finding Market Gaps and Opportunities Competitor analysis is more than just spotting tired messaging - it’s about identifying what’s missing. The real gold lies in uncovering gaps in the market: the unmet needs and untapped opportunities that your competitors haven’t addressed. These gaps are where your brand can step in and claim authority. By analyzing competitor messaging, you gain the insights needed to create messaging that stands out. This process not only highlights competitors' strengths and weaknesses but also reveals underserved customer segments [ 6 ]. These insights can guide you toward niche opportunities and unmet needs, fueling innovation and growth [ 6 ][ 7 ]. The advantage becomes even more pronounced when you refine your value proposition and craft a Unique Selling Proposition (USP). A strong USP showcases what makes your products or services distinct and better, giving customers a clear reason to choose you [ 6 ][ 8 ]. Additionally, competitive intelligence can sharpen your top-of-funnel content, making it more engaging and effective at grabbing attention [ 9 ]. Data-Driven Assessment and Measurable Results When it comes to evaluating a brand, data outshines opinions every time. Yet, many brands still rely on gut instincts or internal biases instead of hard evidence. A structured, data-driven approach transforms brand assessment into a strategic advantage, connecting internal strategies with the realities of the market. The Importance of Fact-Based Assessments The most effective brand evaluations draw from multiple data sources to provide a clear and complete picture of a brand's standing. For example: Customer surveys reveal how your audience genuinely perceives your brand. These insights often highlight gaps between how you think your brand is viewed and how it’s actually received. This helps you see if your messaging hits the mark - or misses entirely. Message testing allows you to gauge audience reactions before launching a full campaign. Instead of guessing whether a new tagline will resonate, you’ll have concrete data showing how it performs across various customer segments. Competitive audits bring an external perspective that internal teams might overlook. By analyzing competitors’ positioning, messaging, and market presence, you can uncover opportunities and threats that might not be obvious from the inside. This kind of intelligence helps you understand not just what competitors are doing, but how well they’re doing it. Together, these tools create a comprehensive framework that shifts branding from guesswork to a science. Measurable Benefits of Objective Assessments Using data-driven insights doesn’t just clarify your brand’s position - it delivers measurable results. When your messaging aligns with what customers truly care about, they respond more positively. For instance, unaided awareness studies often show improved brand recall and stronger top-of-mind positioning. Brands that undergo objective assessments frequently see faster and more accurate recognition when customers are making purchase decisions. Higher conversion rates are another clear benefit. When your brand communicates its value effectively and stands out from competitors, more prospects turn into paying customers. This improvement can be seen across various touchpoints, from website performance to sales team success. Stronger positioning also supports premium pricing, increases customer lifetime value, and lowers acquisition costs. Plus, it tends to attract more qualified prospects who are ready to make a purchase. These measurable results create a feedback loop, allowing brands to make regular, data-informed adjustments. Over time, this approach empowers brand leaders to refine their strategies and drive consistent growth. How Brand Assessments Drive Growth Objective brand assessments can transform business performance by turning external insights into measurable growth. They bridge the gap between understanding your brand and implementing strategies that drive results. Before and After: The Impact of Brand Assessments The difference between a scattered brand and a unified one is hard to ignore. Many brands operate with fragmented messaging - one channel might highlight innovation, another focuses on reliability, while a third emphasizes community. This lack of cohesion confuses customers and dilutes the brand's overall impact. But after a thorough brand assessment, everything changes. Messaging becomes consistent across all platforms. Whether it’s a website, a sales pitch, or a social media post, every interaction reinforces the same core values. This consistency pays off: brands with aligned messaging see a 23% increase in revenue compared to those with fragmented communication [ 10 ]. The transformation doesn’t stop there. Internally, teams that once operated in silos begin working together with a shared understanding of the brand’s identity. Marketing campaigns become sharper, sales pitches more compelling, and customer service interactions more aligned with the brand promise. It’s not just about looking unified - it’s about performing better. Stopping Scattered Marketing Efforts Unified messaging also helps streamline marketing efforts and optimize resources. Without clear guidelines, marketing teams often chase trends or experiment with inconsistent messages, leading to campaigns that fail to build momentum. Brand assessments solve this by introducing clear frameworks for tone, visuals, and content templates [ 11 ]. These guidelines don’t stifle creativity; instead, they provide structure. Local teams can adapt to their markets while staying true to the brand’s core identity. Centralized content distribution ensures every communication reflects the same values [ 11 ]. Marketing teams save time by reusing consistent assets, and sales teams benefit from materials that align with the brand’s messaging. This unified approach doesn’t just create a seamless customer experience - it also improves efficiency. When every marketing dollar supports the same goal, resources are used more effectively, and the cumulative impact grows. The benefits extend to team morale and productivity. Instead of debating what the brand should say or how it should look, teams can focus on execution. The assessment acts as a roadmap, allowing everyone to work toward a common goal and move the brand forward with confidence. Practical Guide for Brand Leaders Knowing when and how to conduct a thorough brand assessment can make all the difference in staying competitive in today’s fast-paced market. Here’s a practical guide to identifying the right moments to act and taking the necessary steps to ensure your brand remains relevant. Spotting the signs early can help you address potential issues before they grow into larger challenges. Signs It's Time for an Objective Brand Assessment There are several telltale signs that your brand might need a closer look. Major changes within your business - such as launching new products, navigating market shifts, mergers, or securing funding - often mean your brand’s current positioning might no longer align with your goals [ 12 ][ 13 ]. A dip in performance is another clear signal. If you’re noticing declining sales, underwhelming campaign results, or poor KPIs, it could point to deeper issues with your brand messaging [ 12 ][ 13 ]. Customer confusion or outdated brand elements also serve as strong indicators. If customers struggle to understand what your brand stands for, or if your branding feels stuck in the past, it’s time to reassess [ 12 ]. Internal misalignment is another red flag. When leadership teams clash over brand goals or employees can’t articulate the brand’s value clearly, it often translates to a muddled external image [ 12 ][ 13 ]. Lastly, if your brand starts blending into the crowd or losing ground to competitors, it’s a sign your positioning isn’t working. An objective review can help uncover ways to stand out and reclaim market share [ 13 ]. When these warning signs appear, acting quickly is key to staying ahead. How Often Should Brands Conduct an Assessment? The timing of brand assessments varies depending on your industry and business needs, but there’s growing evidence that regular reviews are becoming more critical. For example, 90% of companies say their industries have grown more competitive in the past three years, with nearly half describing the shift as significant [ 17 ]. Add to that the fact that around 30,000 new products hit the market annually, and it’s clear why staying relevant requires constant attention [ 17 ]. For most brands, an annual assessment is a good starting point to keep tabs on competitive trends and shifting customer preferences [ 14 ]. However, industries that move quickly may need to assess key brand elements every quarter [ 14 ]. Beyond routine check-ins, certain events call for immediate action. Expanding into new markets, leadership changes, economic disruptions, or bold moves by competitors are all triggers for a brand review. If your company’s progress feels slower than expected or external forces are reshaping your industry, waiting for the next scheduled assessment could mean missing critical opportunities [ 15 ][ 16 ]. Choosing the Right Partner for the Job Once you’ve decided to reassess your brand, the next step is finding the right external partner to guide the process. The ideal partner should bring strong research skills and strategic expertise - not just design capabilities. Look for someone who can perform in-depth customer surveys, competitive analyses, and message testing that explore both the emotional and logical drivers behind customer decisions. A great partner will know how to turn these insights into actionable strategies that differentiate your brand and boost revenue. They should also clearly show how their recommendations connect to measurable business outcomes. While familiarity with your industry can be helpful, it’s more important that the partner excels in delivering solid research and strategic advice. Collaboration is equally important. The best partners work closely with your internal teams to ensure their findings lead to meaningful changes across marketing, sales, and product development. When evaluating potential partners, ask for case studies that demonstrate how their work has led to tangible improvements, like a stronger market position, revenue growth, or successful expansion into new markets. The Last Word: Using Objectivity to Move Your Brand Forward Taking an objective look at your brand isn’t just a good idea - it’s a game-changer. Bringing in an external perspective can uncover blind spots that internal teams might overlook. It also helps break free from the rut of “this is how we’ve always done it,” opening the door to fresh opportunities. By combining external insights with a competitive review, you can pinpoint where your messaging might be falling flat and where untapped opportunities lie. When industry messaging starts to blur together, customers often shift their focus to price instead of forming a real connection with your brand. A competitive analysis can help you find the gaps where your brand can truly stand out. Relying on data-driven insights takes the guesswork out of decision-making. Instead of relying on gut instincts or internal politics, tools like customer surveys, message testing, and perception audits provide solid evidence of what works. This kind of clarity empowers your team to make confident, strategic moves. But perhaps the biggest benefit of an objective assessment is the alignment it fosters within your organization. It helps eliminate disjointed marketing efforts that waste time and confuse your audience. Instead, it creates a clear, fact-supported narrative that everyone on your team can rally around. When leadership and marketing are aligned, the brand strategy becomes more focused and impactful. Ultimately, adopting an objective view of your brand sets the stage for growth. The question is: will you take action on these insights before your competitors do?